EMCAF Portfolio

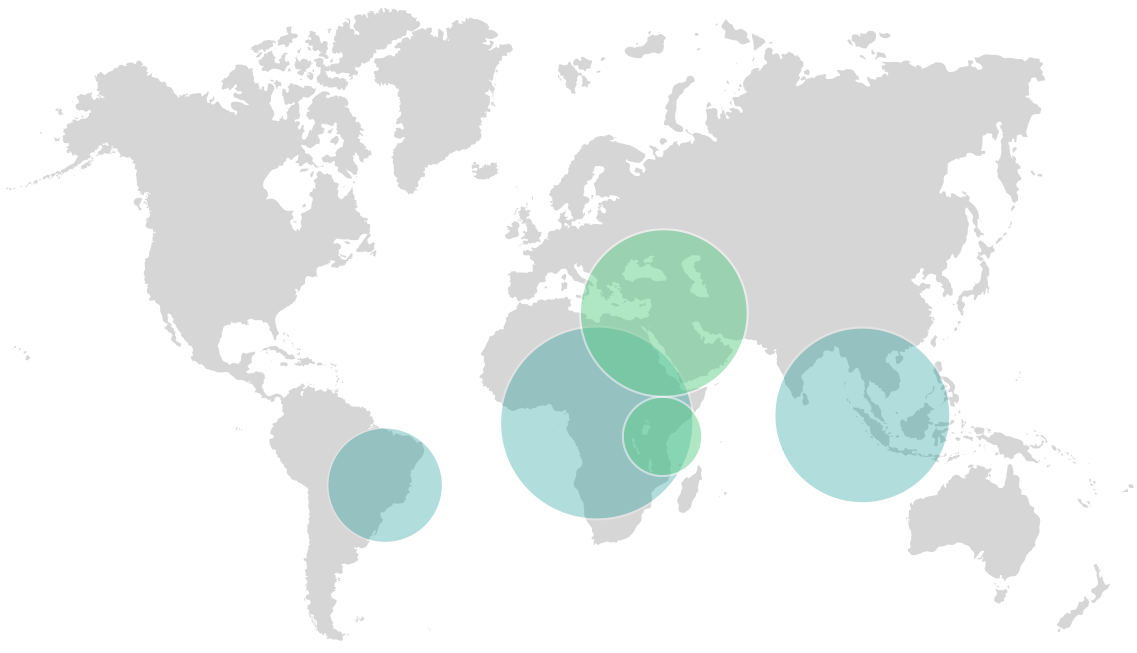

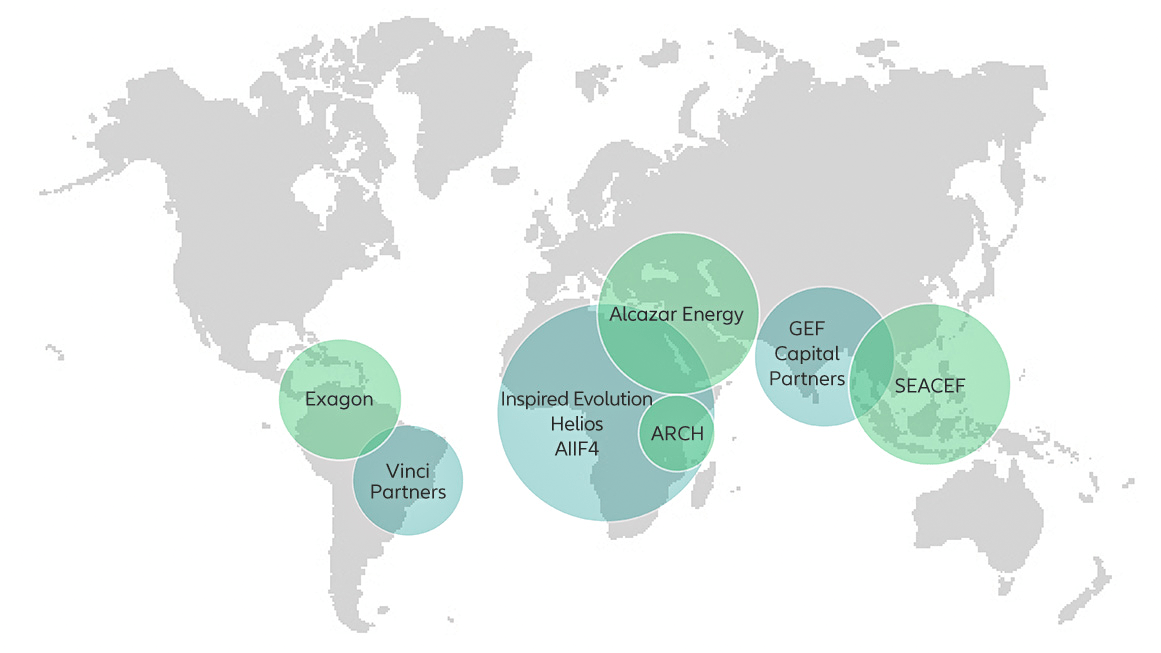

The Emerging Market Climate Action Fund („EMCAF“) targets climate mitigation and adaptation as well as sustainable funds active in emerging and developing countries. The following funds are portfolio investments of EMCAF and demonstrate the scope and range of investments across various themes, impact areas and geographies.

ARCH Cold Chain Solutions East Africa Fund

EMCAF has committed USD 15mn to ARCH Cold Chain Solutions East Africa Fund LP, advised by ARCH Emerging Markets.

The Fund finances greenfield development, construction and operation of temperature-controlled storage and distribution facilities in East Africa to reduce high rates of food spoilage due to lack of refrigeration. The Fund operates at the nexus of climate change, food security and health, with clients and beneficiaries expected to be active mainly in the agriculture/food and pharmaceuticals (incl. vaccines) sectors.

Alcazar Energy Partners II (AEP II)

EMCAF has committed USD 25mn to Alcazar Energy Partners II advised by Alcazar Energy.

The Fund finances greenfield development, construction and operation of renewable energy projects primarily in the Middle East and North Africa. It is expected that this fund will enable the development and construction of over 2GW of clean energy capacity in its target markets. This investment will contribute to:

Evolution III Fund

EMCAF has committed USD 20mn to Evolution III Fund managed by Inspired Evolution.

The Fund finances energy transition across the African continent, focusing on greenfield and expansion opportunities in the utility-scale, decentralized C&I, as well as off-grid renewable energy space. It will also invest in resource efficiency-focused businesses that do more with less and reduce resource footprint. This investment will contribute to:

South Asia Growth Fund III

EMCAF has committed USD 30mn to South Asia Growth Fund III managed by GEF Capital Partners.

The Fund will provide growth capital to mid-market companies which aim to contribute to climate mitigation and adaptation across renewable energy, energy efficiency, food security, water security and mobility sectors and their related value chains in India and opportunistically in Southeast Asia.

The African Infrastructure Investment Fund 4 (“AIIF4”)

EMCAF has committed USD 30mn to AIIF4 Climate Investment L.P. (“ACI”) side car.

ACI is a dedicated vehicle within the AIIF4 Fund, set-up for EMCAF to invest in climate and environmentally focused infrastructure assets in Africa. The strategy will support the build out of renewable energy capacities, energy networks, energy efficient data centres, e-mobility and cold storage solutions and therewith contribute to climate mitigation & adaptation activities.

Helios Climate, Energy, Adaptation and Resilience Fund (“CLEAR”)

EMCAF has committed USD 25mn to CLEAR.

The Fund will invest equity in growth-stage companies that deploy climate solutions across the African continent. The Fund will invest in five key areas: (i) climate-smart food and agriculture, (ii) sustainable transport and logistics, (iii) renewable energy solutions, (iv) resource efficiency, and (v) climate enablers, including climate tech and climate-focused financial services.

South East Asian Climate Energy Fund II (SEACEF II)

EMCAF has committed USD 15mn to SEACEF II.

The Fund will make scale-up and growth equity investments into businesses using proven technologies and established business models that aim at accelerating the low carbon transition in Southeast Asia. The Fund’s target sectors are solar, wind, energy storage, energy efficiency, electric mobility, and grid infrastructure.

Website for the Emerging Markets Climate Action Fund, an initiative together with the European Investment Bank. The fund is approved by the BaFin, but we do not seek external investors for this fund. The website is for image and information purposes only, specifically for certain persons having professional investment experience or potential target funds . Multi-Asset private impact investments are highly illiquid and designed for professional investors pursuing a long-term investment strategy only.

This document does not constitute an offer to sell or a solicitation of an offer to buy interests in any strategy or investment product sponsored or managed by Allianz Global Investors, but is only intended to provide general information about the strategy and may not be relied upon in connection with any offer or sale of securities.

The views and opinions expressed herein, which are subject to change without notice, are the views and opinions of the issuer and / or affiliates at the time of publication. The data used come from various sources and are believed to be correct and reliable. The terms and conditions of all underlying offers or contracts that have been or will be made or concluded take precedence. This document does not contain any statements about the suitability of the investments described here for the individual circumstances of a recipient. This is a marketing communication issued by Allianz Global Investors GmbH, www.allianzgi.com, an investment company with limited liability, incorporated in Germany, with its registered office at Bockenheimer Landstrasse 42-44, 60323 Frankfurt/M, registered with the local court Frankfurt/M under HRB 9340, authorised by Bundesanstalt für Finanzdienstleistungsaufsicht (www.bafin.de). Allianz Global Investors GmbH has established branches in France, Italy, Spain, Luxembourg, Sweden, Belgium and the Netherlands. Contact details and information on the local regulation are available here (www.allianzgi.com/Info). The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted; except for the case of explicit permission by Allianz Global Investors GmbH.

AdMaster 2065301, 2830259, 3293118, 3645586, 4173138